In the last post, we described how technology is enabling a more proactive maintenance approach, and how integrated asset management takes on greater importance. This is dramatically changing the nature of supplier relationships and placing new challenges on how Maintenance and Supply Chain Managers work with suppliers. This post will describe how the 7 Sourcing Models* can provide a framework to address those challenges.

The University of Tennessee has recently published research into how these new relationships can be managed. It focuses on “How” rather than “What” organizations buy. This distinction is important as it aligns with the category strategies that support the maintenance strategies. In an environment where the customer has complete control of equipment design, installation, modification and maintenance, the suppliers will be providing easily defined products and simple services to well established service and quality levels. A highly defined, arms length KPI-driven approach typically works in these cases. At the other end of the spectrum, where the outcome is strategically imperative to the customer, but the solutions are not well defined, a far more collaborative model is required, and this can go as far as a joint venture with another organization that has complementary capabilities. Examples might include the recent development, testing and scaling-up of electric mining machines. The capabilities of battery manufacturers, mining equipment manufacturers, and innovative mining operators are all required for successful design and industrialization in this unique operating environment with very industry-specific benefits.

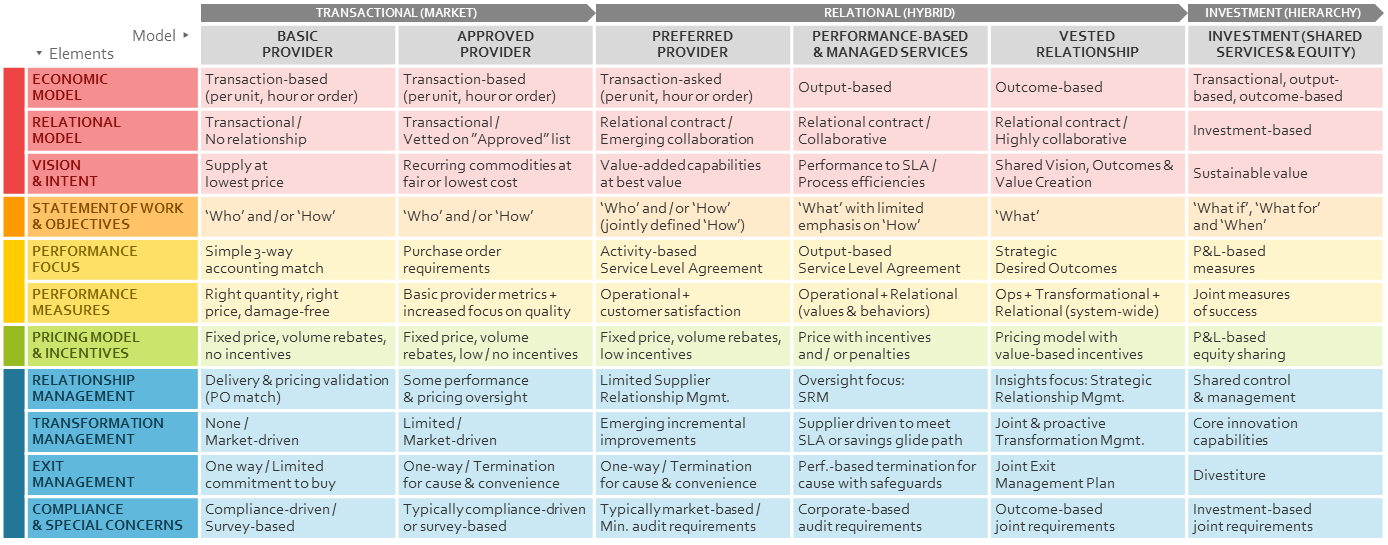

This table summarizes the key characteristics of the various models. Transactional relationships on the left are used for easily defined/specified goods and services with predictable outcomes. Approved vendors have typically been vetted for basic risk through compliance to generic risk parameters (business continuity, performance, service, warrantee…) and may have conceded preferential terms (price, service) for repeat business. Preferred suppliers typically offer greater benefits such as unique accommodations or innovations specifically undertaken for this customer. In exchange for sustained business and priority access to new business opportunities, preferred suppliers are expected to offer greater value through industry best practices that may be adapted to customer specific situations. These might include dedicated or consignment inventory, onsite staff, customized dashboards, or any number of innovative industry practices.

Performance-based agreements seek to achieve defined results through service level agreements with qualified providers with distinct competitive advantages (low-cost labour, specialized or dedicated systems and/or facilities, unique competencies, less onerous regulations…) These arrangements work well for situations that are well defined and evolve gradually, where greater capability or effort can drive greater performance that can be rewarded with monetary and other incentives.

When the stakes are high – volatile, uncertain, strategically critical – calling for unique and rare competencies, a highly collaborative relationship model may be called for. These relationships mobilize the best capabilities from the most qualified and capable service providers. Through aligned goals and significant incentives for shared success, Big Hairy Audacious Goals (BHAG) can be credibly addressed. The ongoing relationship management is principally concerned with how to handle the inevitable unexpected issues and opportunities. This is the most strategically integrated commercial model before financial control is exercised through Joint Ventures or Shared Service Centres. It is also the riskiest, given the uncertainty, high stakes, and management through third-party challenges.

There is a significant challenge in many organizations to keep these models internally consistent. Many organizations are tempted to call their relationship collaborative and strategic, while they manage the day-to-day operations to tactical KPIs with severe penalties for failure to perform. There is little incentive for the supplier to out-perform, to bring their best ideas to the table, to take any risk with the status quo. Others may seek a collaborative relationship where there is limited benefit. No matter how much the parties share ideas, their activity together just doesn’t warrant the effort (e.g. office supplies).

In Summary

As new business models emerge in Integrated Asset Management, both suppliers and buyers are stretching the traditional transactional model. Becoming more collaborative to achieve strategically significant goals (BHAGs) and drive real competitive-differentiating innovation has become an imperative. The 7 Sourcing models provide a framework to chart how new commercial models can support your strategic intent in an internally consistent manner that will align common sustainable interests, achieve meaningful goals, while ensuring effective working relationships, management tools, and risk management.

What do you see as the biggest challenges with these new business models? Please comment below…

About the Author:

Nicholas Seiersen has over 40 years of practical experience specializing in Supply Chain Management with a primary focus in Strategic Sourcing, Supply Chain Planning, Logistics, and durably removing costs out of the total supply chain.

He has provided improved performance across many industry sectors including: Government, Consumer, Retail, Metals & Mining, Energy, Transportation, High Technology and Diversified Industrials.

Nicholas has authored or co-authored almost 50 publications, including the 2017 book “Le Bon Accord Avec Le Bon Fournisseur” and is highly active as professional speaker. Nick resides in Toronto, Ontario Canada.